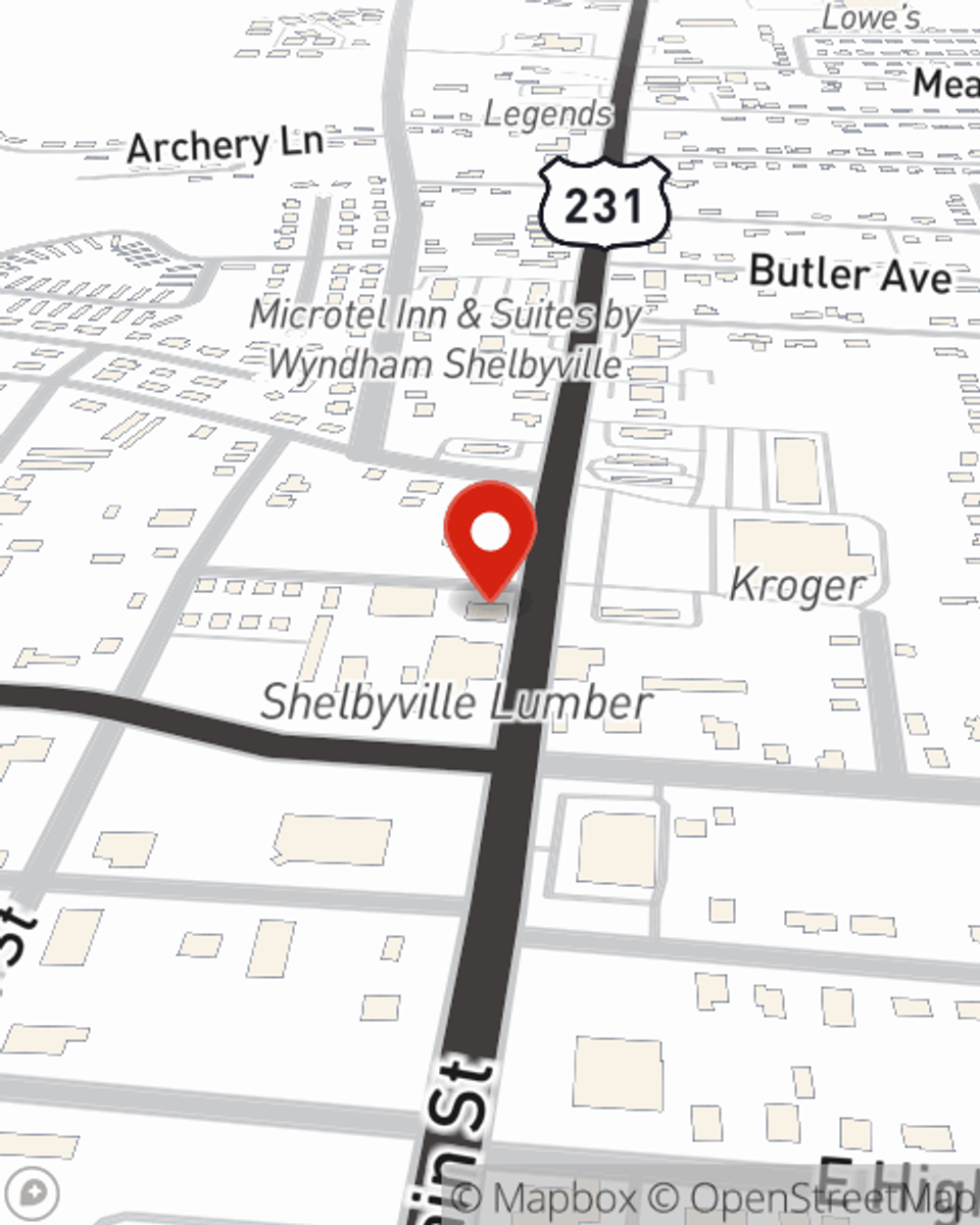

Business Insurance in and around Shelbyville

Looking for small business insurance coverage?

Insure your business, intentionally

- Bedford County

- Moore County

- Lynchburg

- Murfreesboro

- Christiana

- Tullahoma

- Petersburg

- Lincoln County

- Rutherford County

- Coffee County

- Woodbury

- Cannon County

Insure The Business You've Built.

Preparation is key for when a problem happens on your business's property like an employee getting hurt.

Looking for small business insurance coverage?

Insure your business, intentionally

Small Business Insurance You Can Count On

With State Farm small business insurance, you can give yourself more protection! State Farm agent Deb Insell is ready to help you prepare for potential mishaps with reliable coverage for all your business insurance needs. Such individual service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If you have problems at your business, Deb Insell can help you file your claim. Keep your business protected and growing strong with State Farm!

Take the next step of preparation and call or email State Farm agent Deb Insell's team. They're happy to help you research the options that may be right for you and your small business!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

Deb Insell

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.